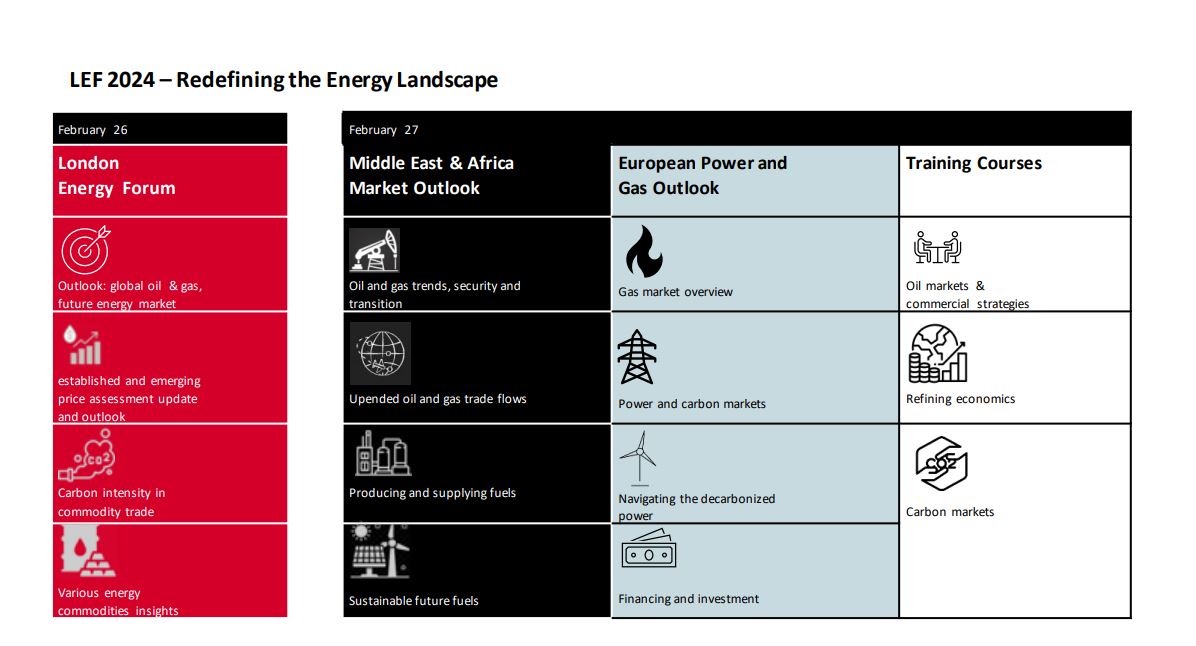

Redefining the Energy Landscape

S&P Global Commodity Insights proudly presents the return of the London Energy Forum, set to ignite International Energy Week on February 26-27, 2024.

The London Energy Forum has steadily evolved over the years, drawing an increasingly diverse and influential audience. In 2024, our commitment to delivering cutting-edge insights remains unwavering as we explore the dynamic and ever-changing landscape of the energy sector.

For 2024, we're thrilled to introduce a new two-day program, broadening our content to include 3 additional elements:

Refining Economics & Refineries of the Future Training Course – 27th February

The training courses will be conducted by our specialists, providing access to fundamental knowledge and tools imperative for understanding the landscape of different commodities.

- Training course: Refining Economics & Refineries of the Future

Middle East & Africa Market Outlook – 27th February

Focusing on oil and gas trends, trade flows, refining landscape changes, and the transition to sustainable future fuels. Join industry experts for essential conversations on economic diversification, geopolitical influences, and market dynamics, as well as energy investment in a decarbonized future.

European Power and Gas Outlook – 27th February

Delve into the evolving European energy landscape as we address the vital topics of security of supply, renewable power sources, and the transition to decarbonization, all while unraveling the value chains, understanding regional implications, and exploring investment opportunities in the power & gas sectors.

Get the latest event updates and news from S&P Global Commodity Insights.