THIS EVENT STARTS IN

Training Course Only Rate: $1750

Register by Friday, April 26 to save $200.

Enjoy early access to the registration list, 1:1 direct messaging, extra content, and more.

June 25, 5:00 pm MDT

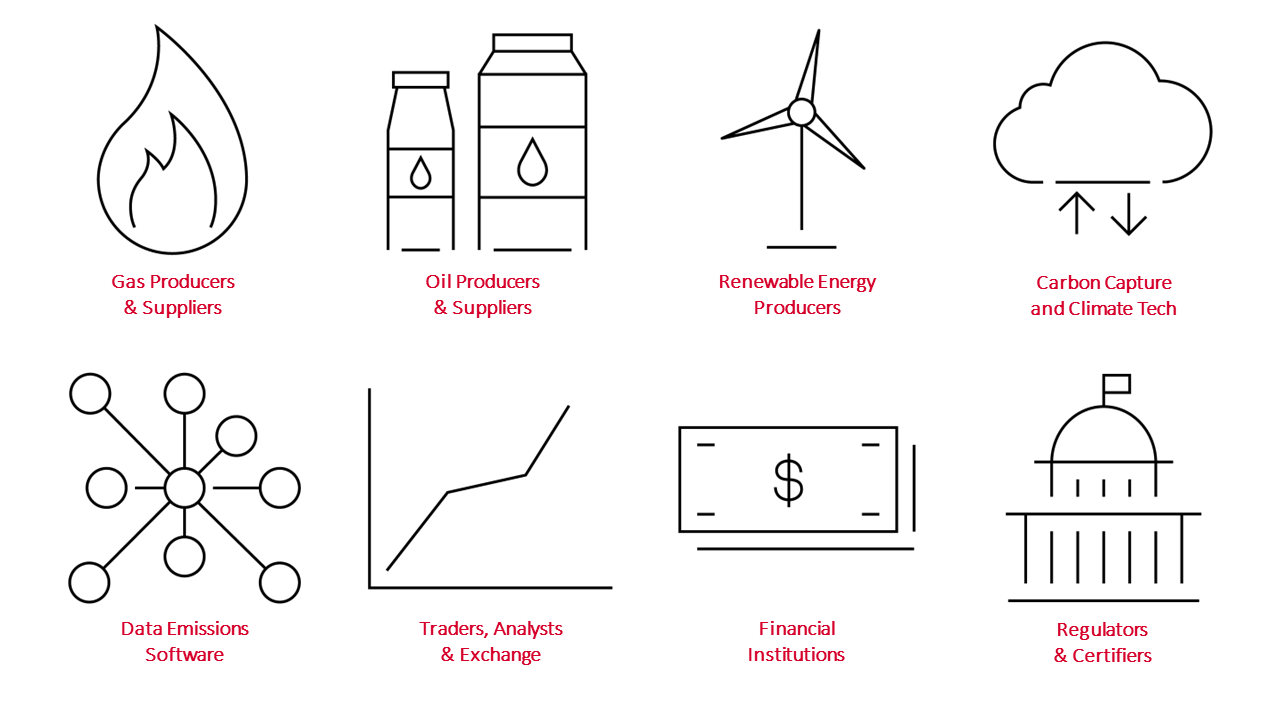

Who attends

Training course add-on:

Carbon Markets Fundamentals

Agenda

Tuesday, June 25, 2024 - Supplementary Pre-Conference Training Course

- Instructors:

Roman Kramarchuk, Head, Climate Markets and Policy Analytics,

S&P Global Commodity Insights

Deb Ryan, Head of Emissions Insight,

S&P Global Commodity Insights - Carbon Markets and Pricing Overview

— Why do we need a carbon price?

— What are carbon pricing tools and how do they work?

— Different types and purposes of carbon markets and pricing

— Overview of different features and dynamics - How do Carbon Markets and Pricing fit within Global Climate Policy?

— A global challenge: politics & economics of climate change

— Comparison of climate policy instruments

— UN frameworks: the Paris Agreement, UNFCCC, COP process and the Sustainable Development Goals (SDGs)

— Key global institutions on carbon markets - Compliance Carbon Markets & Pricing

— Carbon trading (ETS) versus carbon tax

— Global compliance markets and pricing schemes

— Regional specifics and development in key economies (G20) - The voluntary Carbon Markets

— What is the VCM and how does it work?

— Key VCM bodies, stakeholders and participants

— Supply-side: various project types, nature vs tech-based, reduction/avoidance vs removals, credit-generation process, what do we mean by high quality?

— Demand-side: buyers' perspective, preferences and making claims

— Trading: ratings, exchanges, trends and barriers

— Global & regional trends - Article 6 & Global Carbon Linkages

— What is Article 6 and what does it do?

— Progress of 6.2 and 6.4 mechanisms

— EU Carbon Border Adjustment Mechanism (CBAM)

— Carbon clubs - Nature-based Solutions & Biodiversity

— What are nature-based solutions (NBS) and natural climate solutions (NCS)?

— The size of the prize: what is their potential?

— Opportunities and challenges for scaling

— Linkages between NBS, land-use and agriculture

— Biodiversity as a metric and crediting - Implications for Corporates

— Fundamentals of net-zero

— Corporate strategies for carbon management

— Carbon market Investments

— Different carbon accounting frameworks

— Reporting requirements relating to climate and nature-based risks

- 8:00 am Registration and Networking breakfast

- 8:30 am Instruction Begins

- 12:00 pm Networking Lunch

- 5:00 pm Training ends

Wednesday, June 26. 2024

- 8:00 am Registration and Networking breakfast

- 9:00 am Chair’s welcoming remarks

- Deb Ryan, Head of Emissions Insights,

S&P Global Commodity Insights - 9:15 am KEYNOTE Advancing a reliable, sustainable energy future: API's climate action framework — Addressing climate challenges while ensuring a reliable energy supply

— Accelerating technology and innovation, mitigating emissions from operations, endorsing a carbon price policy, advancing cleaner fuels, and driving accurate and transparent climate reporting

— Collaborative efforts between the energy industry, government, and other stakeholders to reduce emissions, support innovative climate solutions and promote GHG data accuracy and transparency - Jennifer Stewart, Director, Climate Policy,

American Petroleum Institute - 09:35 am Climate scenario analysis and the energy transition outlook — How are energy markets reacting and adapting to energy transition?

— Analyzing the impact of climate scenarios on the progression of the energy transition

— Exploring the role of carbon markets in shaping energy outlooks: Identifying risks and opportunities

— Anticipating market dynamics and capitalizing on arbitrage opportunities for competitive advantage - Roman Kramarchuk, Head, Climate Markets and Policy Analytics,

S&P Global Commodity Insights - 09:55 am PANEL DISCUSSION Unveiling methane detection with aerial methane imaging: The power of actionable information — Optimize granular information collected through optical images and GPS location data

— Swift problem resolution: Tracing the methane trail to elusive sources with state-of-the-art monitoring technologies

— Transitioning from private aggregated data to public granular data: Prioritize total volume reduction over the count of methane leaks - Vanessa Ryan, Methane Reduction Manager,

Chevron

Ryan Mattson, VP Oil and Gas,

GHGSat

Kayla Ball, Director of Digital Solutions,

The University of Texas at Austin

Moderator: Raoul Leblanc, Vice President for North American Upstream,

S&P Global Commodity Insights - 10:25 am PANEL DISCUSSION Harnessing continuous monitoring systems and machine learning to address methane emissions — Empowering investors and the insurers: Identifying top-performing operators, high-risk operators, and methane emission sources with established baselines and monitoring tools

— Leveraging machine learning for effective emissions management

— Ensuring the accuracy of measurements to inform mitigation strategies

— Rendering emissions data accessible and actionable - Steve Liang, Founder,

SensorUp

Ethan Emerson, Research Scientist,

Colorado State University

Nav Chawla, Head of Digital,

Civitas Resources

Moderator: Emmanuel Corral, Senior Emissions Insight Analyst, Center of Emissions Excellence,

S&P Global Commodity Insights - 10:55 am Networking and Refreshment Break

- 11:10 am Genius Exchange Presentation: “Realizing the Value of your Emissions Data”

- Discover latest climate technology for carbon removals

- 11:40 am PANEL DISCUSSION Discover the latest experience from CCUS projects and relevant technologies — Insights into the diverse and latest advancements of technologies utilized in carbon capture, utilization, and storage (CCUS), including both carbon removal and point-source capture

— Delving into the experience and lessons learned in real-world commercial-scale CCUS projects

— Discovering the collaborative efforts between public-private partnerships to bridge the gap between academic innovations and practical implementation

— Discussing the broader role of governmental support in advancing CCUS projects including public-private partnerships and tax credits - David Mora, Vice President – Carbon Solutions,

NextDecade

Joshua Schaidle, Lab Program Manager, Carbon Management,

NREL

Aseem Telang, Program Manager, ESG and Air,

BKV Corp

Moderator: Yufei Li, Senior Research Analyst, Global Clean Energy Technology,

S&P Global Commodity Insights

- 12:10 pm Discover carbon sequestration with Biochar to support carbon neutral fuels — Learn how Carbek evaluates upstream carbon projects to create feedstocks for carbon-neutral fuels, carbon dioxide removal (CDR), and biochar

— Discover Carbek's integration with SAFTERRA, an emerging partnership of carbon-neutral projects organized to establish a vertical supply chain of green methanol, addressing global demands for sustainable aviation fuel - Ryan Shore, CEO,

Carbek - 12:35 pm Networking Lunch

- 1:50 pm Transitioning utilities: Complement traditional gas with diverse energy solutions — The role of renewable natural gas and hydrogen blending

— Reducing emissions through adopting electric heat pumps and appliances: Are all-in-one electric heat pumps the optimal substitute?

— Making electric appliances more accessible and scalable for homeowners: Could complete reliance on electrification strain the grid?

— The role of natural gas through the energy transition - Norris Wright, Vice President,

Constellation

Grace Jones, Project Manager, Gas Alternative Investment Program,

Xcel Energy

David Weyburn, Director, Strategic Partnerships and Infrastructure,

SJI Renewable Energy Ventures

Keith Shoemaker, SVP – Commercial,

EQT

Moderator: Heather Jones, Head of Emissions Technical, Center of Emissions Excellence,

S&P Global Commodity Insights - 2:35 pm Increasing demand for lower methane intensity gas — Demonstration performance: the role of certified gas

— Growing utilization of certified gas to quantify life-cycle carbon intensity

— Who should pay the price to clean up gas? - Kelly Bott, SVP, ESG, Land, Regulatory,

Pure West

Scott Yager, Vice President, Environment,

Interstate Natural Gas Association of America

Edward Lush, Director, Low Carbon Products,

Williams

Moderator: Eamon Monahan, Director of Government Affairs,

Context Labs - 3:05 pm Networking and Refreshment Break

- 3:20 pm Genius Exchange Presentation: “Why Every Organization Needs High Integrity Carbon Projects as part of their ESG Strategy?”

- 3:45 pm PANEL DISCUSSION Exploring affordable, secure, and sustainable alternatives to fossil fuels — Sustainable fuel solutions to decarbonize transport

- Jennifer Aurandt-Pilgrim, PhD Vice President,

Marquis R&D Energy LLC

Dr. Chendhil Periasamy, Vice President, Carbon Management & Emerging Markets, Hydrogen Energy and Mobility,

Air Liquide

Moderator: Tinu Abraham, Emissions Research Analyst, Center of Emissions Excellence,

S&P Global Commodity Insights - 4:15 pm PANEL DISCUSSION An examination of new environmental certificates: Trends and innovations — Exploring the realm of RECS, methane certificates and evolving differentiated gas market

— Identifying emerging environmental product innovations

— Assessing the oil and gas sector’s ability to develop carbon credits - Ben Webster, Director of Policy,

MIQ

Megan Lorenzen, Director, Climate & Energy,

Salesforce

Reid Calhoon, CEO,

ClimateWells

Moderator: Anne Robba, Head of Future Energy Signposts,

S&P Global Commodity Insights - 4:45 pm Colorado Energy and Carbon Management

- Julie Murphy, Director,

Colorado Energy & Carbon Management - 5:00 pm Chair’s closing remarks

- 5:10 pm Networking Drinks Reception

Thursday, June 27, 2024

- 8:30 am Networking breakfast

- 9:00 am Chair’s recap of day two

- Deb Ryan, Head of Emissions Insight,

S&P Global Commodity Insights - 9:10 amExploring California’s Low Carbon Fuel Standard — Reducing the carbon intensity of California's transportation fuel pool by offering low-carbon and renewable alternatives

— Assessing the influence of LCFS on innovation and investment in various low-carbon fuelsr

— Examining the fluctuation in LCFS credit prices

— Evaluating the LCFS’ potential cost saving and contributions to net-zero goals: Assessing its adequacy in meeting industry objectives - Jordan Ramalingam, Low Carbon Fuels Policy Manager,

California Air Resources Board - 9:25 am PANEL DISCUSSION Examine carbon market mechanisms in North America — Active carbon pricing programs (WCI) and its effectiveness in reducing emissions

— RGGI cap-and-trade program to limit emissions from the power sector

— Comparing cap-and-trade with cap-and-invest initiatives taking effect (WCI, RGGI and WCA) - Stephanie Potts, Senior Cap-and-Invest Program Planner,

Washington Department of Ecology

Roman Kramarchuk, Head, Climate Markets and Policy Analytics,

S&P Global Commodity Insights

Jordan Ramalingam, Low Carbon Fuels Policy Manager,

California Air Resources Board

Moderator: Ander Garcia, Carbon Price Reporter,

S&P Global Commodity Insights - 9:55 amEssential insights into carbon credit pricing for your decarbonization strategy — Unraveling the factors influencing carbon market prices and driving carbon credit valuation

— Grasping the market fundamentals dictating carbon credit price dynamic

— Comparing older versus newer carbon credits: Performance analysis and market trends

— Interpreting diverse levels of carbon credit prices for informed decision making - Hope Pagan-Ramos, Low Carbon Pricing Analyst,

S&P Global Commodity Insights - 10:15 am INTERVIEW Navigating environmental markets and low carbon solutions: Reductions versus costs — System wide investment: Investing in low carbon energy forces

— Addressing the energy trilemma: Striking a balance between energy security, sustainability and affordability

— Outpacing the abatement curve to foster economic growth - Christie Prescott, Director, Wholesale Power Contracts,

The United Illuminating Company

Moderator: David Lademan, Global Team Lead, Carbon Accounted Commodities,

S&P Global Commodity Insights - 10:35 amNetworking Break

- 11:05 am FIRESIDE CHAT The role of carbon offsetting in a sustainability strategy: Strategies, markets & products

- Zach Scott, Head of US Carbon,

Trafigura

Adam Raphaely, Managing Director, Trading & Environmental Products,

Mercuria Energy America, LLC

Moderator: Hope Pagan-Ramos, Low Carbon Pricing Analyst,

S&P Global Commodity Insights

- 11:35 pmConversation with a net-zero visionary: Why and how to incorporate carbon offsets into your sustainability plan today — Purchasing carbon credits from verified project that equivalently reduce or eliminate emissions matching your carbon footprint

— Navigating various standards to source high-quality Carbon credits at a transparent prices

— Establishing a framework to guarantee the legitimacy of carbon credit’s offset capability - April Allderdice, Co-Founder and CEO,

MicroEnergy Credits

Moderator: Bob Macknight, Managing Director, Nature & Climate Solutions,

S&P Global Sustainable1 - 12:05 pm PANEL DISCUSSION Assessing removals versus avoidance carbon credits — Compare the quality of emission reduction and removal carbon credits

— Reviewing permanence and measurability of impact

— Examining policy support for removals and reduction - Craig Ebert, President,

Climate Action Reserve

Jenny Morgan, Market Development Manager,

Tradewater

Rob Lee, Chief Carbon Officer,

Catona

Panel Moderator: Duncan van Bergen, Co-Founder,

Calyx Global - 12:50 pm FIRESIDE CHAT Strategies for securing climate project financing amid decarbonization market dynamics — Deciphering lenders’ criteria for financing decarbonization projects in oil and gas

— Assess the impact of regulation and investor sentiment on capital accessibility across different regions

— What are financed emissions, and how are banks exploring decarbonization? - Stuart Page, Senior Consultant, LPO,

Department of Energy

Siddharth Agarwal, Investment Leader, Infrastructure,

Partners Group

Bob MacKnight, Managing Director, Nature & Climate Solutions,

S&P Global Sustainable1

Vijnan Batchu, Managing Director, Center for Carbon Transition,

J.P. Morgan

Moderator: Kevin Birn, Head, Centre of Emissions Excellence,

S&P Global Commodity Insights - 1:35 pm Chair’s closing remarks

- 1:40 pm End of Conference Lunch

Get the latest event updates and news from S&P Global Commodity Insights.