In the vast expanse of chemicals, there's a lot to discover. With our expanding chemical coverage, you can uncover dynamics, trends and drivers from upstream to end-use markets.

Find supply, demand, price benchmarks, trade data, costs, and margins across the full universe of chemical markets.

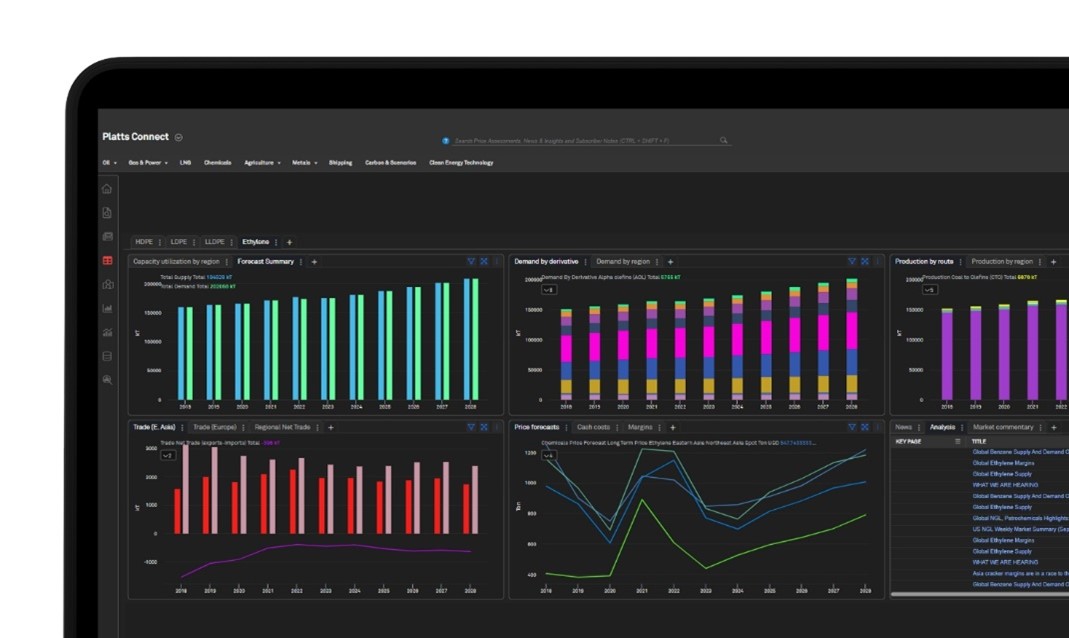

You can access this intelligence through our customizable visual interface. Designed to help simplify your workflows and enable faster decision making.

At S&P Global Commodity Insights we cover everything from chemicals feedstocks to chemical building blocks, their derivatives, all the way to performance chemicals. And that's not all. Thanks to our expanded team of industry experts, now we cover even more chemical markets.

Discover our new customizable visual interface which brings everything you need in a single place. Our new data and insights are integrated with our existing capabilities. S&P Global Commodity Insights provides your data, your way by creating a customized view to suit your needs.

You can:

Our Core Offerings in Detail

Commodity & Intermediate Chemicals

Specialty Chemicals

Connected intelligence

Seamlessly connect our Chemicals insights with S&P Global’s coverage of Crude Oil, Refined Products, NGLs, economic indicators and trade. Because of S&P Global’s extensive coverage of commodities and markets you can be confident in the assumptions behind our Chemicals insights and ensure a consistent, integrated outlook across your entire business.

Comprehensive coverage

Explore dynamics, trends and drivers across a wide spectrum of chemical markets.

All-in-One Platform

Simplify workflows with all the benefits of a modern digital service and a single- screen view of chemicals research, insights, prices, and news for faster decision-making.

Workflow Tools

Tailor your view to suit your needs. Download data for further analysis and power your organization by consuming our API.

Expert Access

Tap into a global network of chemical market experts for critical analysis.

Transparent, Independent Data:

Rely on respected and unbiased data and analysis.

Combining underlying data with visualization and analytical tools, our Chemical Analytics products provide an intuitive and interactive way to save you time collecting data and analyzing trends.

S&P Global Specialty Chemicals Update Program (SCUP) (formerly SRI Consulting's Specialty Chemicals Update Program) provides detailed analysis of the global specialty chemicals industry.

S&P Global Specialty Chemicals Update Program (SCUP) (formerly SRI Consulting's Specialty Chemicals Update Program) provides detailed analysis of the global specialty chemicals industry.

S&P Global Specialty Chemicals Update Program (SCUP) (formerly SRI Consulting's Specialty Chemicals Update Program) provides detailed analysis of the global specialty chemicals industry. SCUP provides a strategic analysis of 38 specialty chemical businesses, including market drivers, key players, industry structure and dynamics, critical factors for success, and threats or opportunities.

PEP provides in-depth, independent technical and economic evaluation of both commercial and emerging technologies for the chemical, biochemical, and refining industries. PEP analyzes the impact of changes in processes, feedstocks, energy prices, and government regulations on chemical and fuel production economics for our clients.

Complete the form and one of our team members will contact you to discuss the challenges you are facing and how our product offerings can help you grow and succeed.

Chemical Economics Handbook (CEH) is a comprehensive market overview with a five-year outlook of key industry drivers, producers, applications, trade, prices, and supply/demand forecasts. Strategic analysis for over 300 chemical products and multiple value chains.

CEH will help you:

Leverage unique strategic analysis and insight.

S&P Global

Specialty

Chemicals Update Program (SCUP) (formerly SRI Consulting's Specialty Chemicals Update Program)

provides

detailed analysis of the global specialty chemicals industry. SCUP provides a strategic analysis of

38

specialty chemical businesses, including market drivers, key players, industry structure and

dynamics,

critical factors for success, and threats or opportunities.

The program is unrivaled in

breadth, depth

and quality of data covering critical factors for success, government regulations, industry

structure, market

participants, market size and growth rates, operating characteristics, prices, products and

functions and

trends and strategic issues. Find out why SCUP is the single source for unique insights into the

global

specialty chemicals industry.

SCUP includes:

Competitive Cost & Margin Analytics (CCMA) provides you with cost and

margin

product positions of 46 chemicals over 6,000 operating chemical plants according to geography,

capacity, time,

technology, feedstock, operating rate, and integration level.

CCMA will help you:

Evaluate the Long-Term Competitiveness of a Plant

Calculate the Impact of Market Changes on Cost and Margin Performance

Inform Purchasing Strategies

View More Information about Competitive Cost & Margin Analytics

Directory of Chemical Producers (formerly the SRI Consulting Directory of

Chemical

Producers) offers a focused view of more than 14,000 chemical firms that collectively produce 21,500

chemical

products in over 90 countries.

DCP is the right choice for:

Compare new chemical process technologies and economics faster and at less

cost.

New chemical manufacturing technologies can pose an opportunity or a threat. Whether

you are

acquiring a new technology or responding to a rival, the ability to quickly compare technical

designs and

production costs is a competitive advantage.

Process Economics Program (PEP) Yearbook is the

world’s

largest online process economics database, with access to 2,000+ process technologies used to

produce 600+

chemicals in 6 regions. The only source for new process analysis, PEP Reports and Reviews allow you

to uncover

the impact of changes in processes, feedstocks, energy prices, and government regulations on

chemical and fuel

production economics. In addition, with the iPEP Navigator, you can generate process economics

tailored to

your project needs.

Chemical, energy, engineering and investment firms use PEP to: