Our perspective on Energy Transition is different than other information providers.

No-one else combines a market leading price assessment capability with 360-degree analytics to connect all perspectives on energy generation and end use, from an asset to a system level.

This is what shapes the view we take to market, which is inherently more observant of the idiosyncrasies that will impact our emissions trajectory through 2050. We spot the signals as they emerge.

Through experience, we recognize that the skills and strategy of our clients are as much a factor in driving energy transformation as policy, markets, or technology. We integrate data and tools built by specialist teams of commodity and fuel experts into a platform that delivers the ever more interconnected workflow solutions our clients need - to be the change the world is seeking.

Complete the form, and a member of our sales team will contact you to discuss our product

and service can help your energy transition strategy.

Customers rely on our

deep data and industry expertise combined with our depth

of insight, market news and commodity pricing that covers the entire value chain

across energy and commodity markets, supply chains, and transportation systems.

This interconnectivity of data, market news, and insights is essential to

advance the energy transition.

Partner with us to support the following

strategies and capabilities.

Navigating the Energy Transition

Standardized data and analytics on greenhouse gas emissions across the global energy value chain and industrial sectors; Price assessments for low carbon oil, gas, and power markets.

Comprehensive coverage of clean energy technologies – batteries & storage, hydrogen & green gas, wind, solar, & carbon sequestration – to support the future energy system; Pricing and insights on voluntary carbon markets.

Integrated, long-term scenarios projecting energy use and emissions by fuel type, country, and sector. Risk assessment and portfolio strategies.

Provide increased transparency, rigor, and integrity to the pricing of voluntary carbon market (VCM) assets, providing the market with greater confidence. Our newly enhanced carbon and environmental registry software solutions enable you to track and manage carbon and environmental credits and connect disparate global environmental markets on an unparalleled, unprecedented scale.

Capabilities to understand and manage the impact of change

We partner closely with market participants to develop assessments and benchmarks that bring transparency and understanding to what moves established and emerging markets

We offer deep industry insights to help navigate change, manage risk and unlock opportunities for current challenges such as Energy Transition and Emissions

We help customers reduce risk, enhance workflows, increase efficiency and optimize business processes by leveraging software, platforms and interconnected data and analytics

We partner with customers and communities to deliver bespoke advisory services, education, webinars, and marquee events like CERAWeek

Our future is

connected.

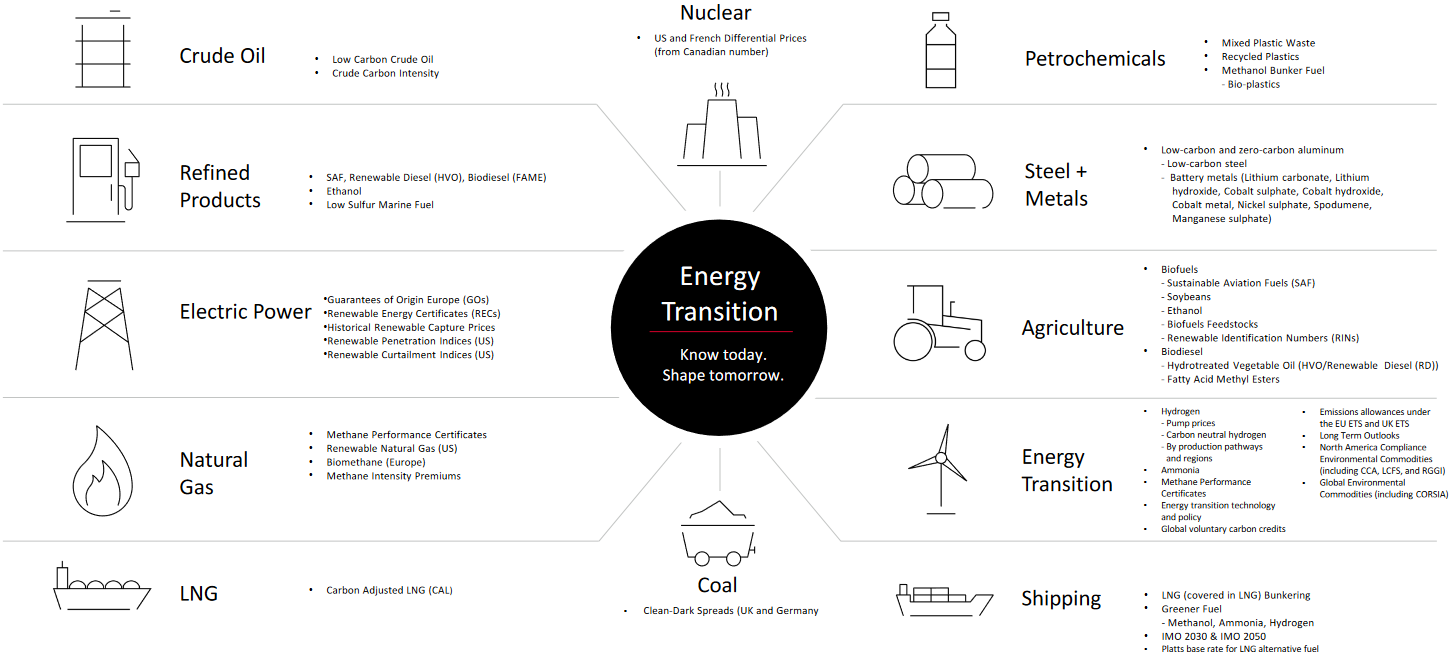

Explore the

commodities ›

Energy transitions present major strategic decision-making challenges for today's

business leaders. You need to gain a comprehensive view of where the move to sustainable

energy is—and where it’s headed.

In addition to our Energy Transition offerings, we offer pricing, analytics and news you

need across the energy markets.

The fast-growing voluntary carbon markets can play an essential role in global businesses’ net-zero journey - and with double-digit growth predicted by 2030, the risks are as significant as the opportunities.

Key Elements of Platts VCM solutions offerings include:

Combined with the most in-depth price assessments with comprehensive data, news, and analysis, confidently navigate the twists and turns of your net-zero journey.

Managing methane emissions is one of the most effective ways to curb the acceleration of global warming and achieving significant reductions today will have a major effect on atmospheric warming potential over the next 10 to 20 years.

Key Elements of Platts MPC offering include:

Platts MPCs are awarded to companies whose gas meets the Platts threshold of methane emissions in production, helping the natural gas market progress towards a lower-carbon solution.

With a growing proportion of renewable generators exposed to merchant price risk, our robust, market-leading forecasts—which now extend through 2050—provide a comprehensive and transparent view of evolving power prices and help you stay ahead of the competition.

Key Elements of Platts European Long-Term Power offering include:

Understand better the changes in the market over the long term and more aptly assess potential revenue opportunities.

We provide in-depth data and analysis to help you identify market opportunities, informed by an understanding of the key policy and technology developments that can meaningfully affect your business.

Key Elements of Platts FEO offering include:

Together, these tools give you a deeper understanding, to shape the insights that underpin lasting competitive advantage.

The most comprehensive commercially available energy demand tool to quickly model, compare, and export long-term energy demand under various scenarios.

Key Elements of Platts GIEM offering include:

Understand the path to decarbonization by viewing our reference and two-degree scenario cases and comparing current trajectory scenarios to access the feasibility rate as the world addresses climate change.

With Hydrogen playing a fast-evolving role in the Energy Transition space, the value of objective, relevant and timely information can never be underestimated. It’s fundamental to decision-making and shaping the future of energy.

Key Elements of Platts Hydrogen solutions offering include:

By empowering you to see things others don’t, we help you confidently choose the way forward.

Our coverage provides fundamental insights on the most important clean energy technologies, addressing energy transition areas critical to long-term strategic planning for a low-carbon future.

Clean Energy Technology solution offers in-depth coverage of the supply chain, economics, and outlooks for:

Define your future activities with the energy technologies that are emerging at the leading edge of the transition.

Gain both qualitative and quantitative analysis and insights on renewable energy sourcing strategies, incorporating in-depth coverage of power procurement market fundamentals, policies, competitiveness analysis, and risk assessment.

Our insights are supported by analytics and databases on trends in:

Procure renewable energy for your company operations worldwide with our hub of insight, analytics, and data.

Identify, track, and benchmark greenhouse gas emissions across value chains and portfolios.

We support businesses in their decarbonization efforts and climate risk assessments by:

Access to robust emissions datasets has become crucial for companies looking to succeed in today’s energy transition landscape.