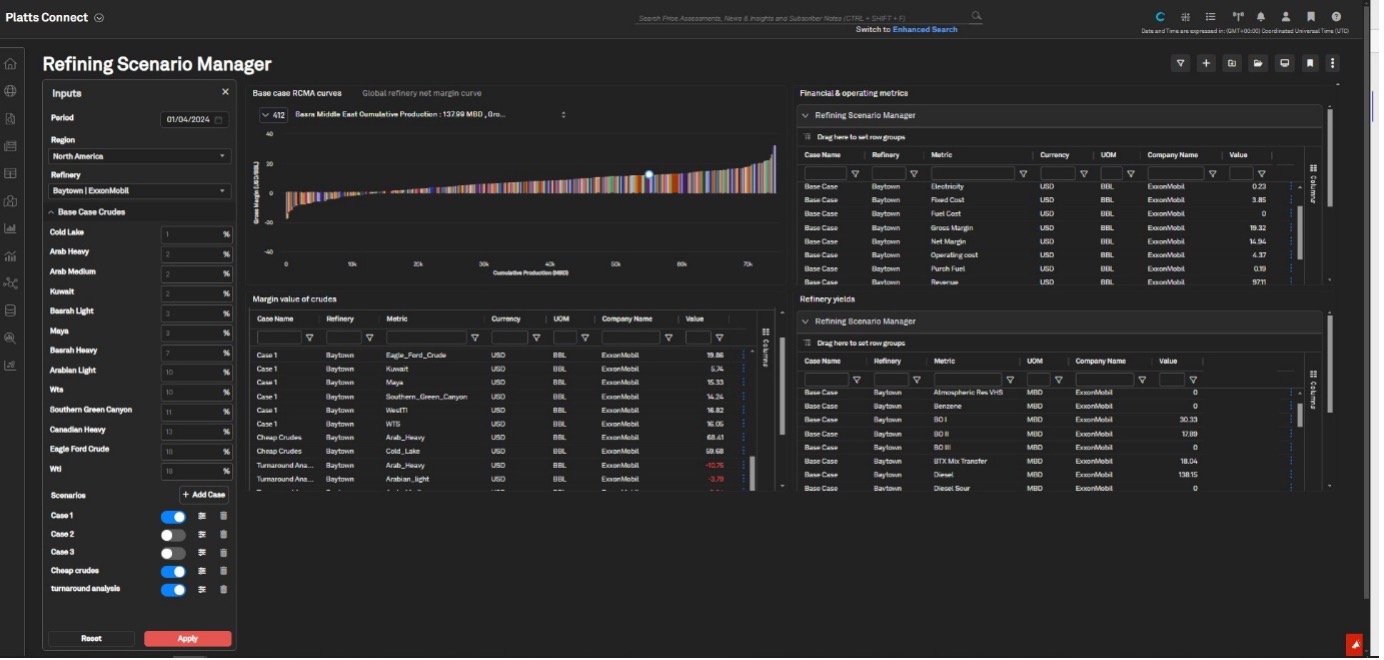

Refining Scenario Manager (RSM) delivers near real-time insights and scenario modelling to optimize trading and refinery operations. With RSM, you can simulate everything from crude pricing to unit-level utilization, uncovering opportunities to enhance efficiency, and gain a competitive edge.

Enabled by Aspen Tech’s Unified PIMS software and integrated with Commodity Insight’s high-quality refinery data, RSM is a robust scenario management capability, adaptable to any refinery configuration. Its cloud-based platform, accessible via Platts Connect, ensures near real-time data.

Dynamic refining scenario management capability, enabling the creation and execution of up to 15 user-configured scenarios for a selected refinery and time period. Simple user interface on Platts Connect illustrating Commodity Insight’s base data for selected refineries — with the ability to input and override parameters relating to:

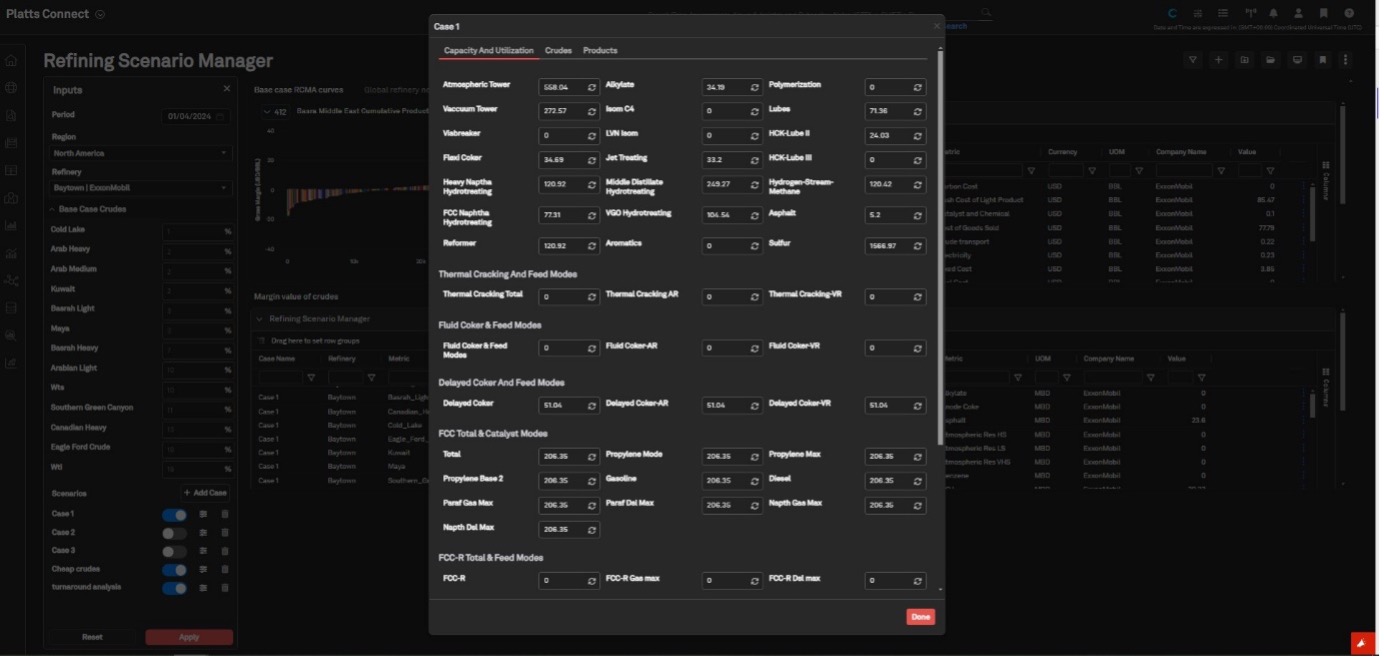

Refinery capacity/utilisation data — granular to the unit level (includes 50+ downstream unit capacities including catalytic crackers, hydrocrackers, cokers, reformers, alkylation, hydrotreaters, lube units, asphalt units, etc)

Crude selection (from a library of 125+ crude slates).

Crude blends

Crude pricing

Crude transportation costs

Product pricing

Scenario results are generated with Commodity Insight’s in-depth refinery models and databases integrated with AspenTech’s world-leading Unified PIMS engine; delivered in near real-time onto Platts Connect.

>90% of global refinery capacity covered.

Scenario outputs provide clarity on:

Refinery-level profitability metrics: up to 15 key financial metrics reported including cash cost to produce light products (CCLP) and net/gross margin estimates.

Refinery throughput.

Refinery-level operating metrics: up to 43 refined products reported.

Marginal crude values.

Scenario data covers 5 years history and 10 years forecast; selected on a quarterly basis.

Scenario data is fully configurable/saveable/downloadable on Platts Connect.

Benchmarking

Understand how peers/competitors/comparable refineries perform under varying conditions and assumptions

Strategy definition

Make informed medium- and long-term crudes and refined product strategic decisions. Define unit-level capacity and investment decisions.

Validate results

Give weight to strategic and investment decisions. Use the model outputs to validate the results of internal LP models.

Effective crude allocation

Plan effective allocation of crudes to owned refineries to maximize profits.

Informed trading decisions

Understand the marginal value of specific crudes for certain refineries supports effective crude trading decisions on the spot market.

Price floors and ceilings

Set crude price floors and ceilings for trading desks using marginal value of crudes data.

Screen M&A/investment targets and due diligence

Model the yields and financials of an existing or prospective refinery to create accurate valuations of assets and make the right investment/financing decisions.