Evolving clear insights from complex markets and remaining one step ahead of the competition is vital. Platts Market Data gives you the actionable, standardized numbers and transparency you need to spot opportunities and make decisions fast. Following our clearly defined guidelines and specifications, we publish thousands of contract and exchange prices, indexes and forward curves every day.

Access market data for the commodities that interest you. Through our global, daily assessments of transactional prices, we can help you get a more complete view of the market – by delivering the actionable numbers you need to gauge your markets, your competition and future potential.

Breadth and depth of data consists of industry leading benchmarks, contract price assessments, aggregated third party data and seasonal trend information

An interconnected view of price influences through access to the industry’s only integrated data sets across commodities, regions and verticals

Connected data sets to view price influences with the industry’s only integrated data sets across commodities, regions and verticals

Diverse new data sets to stimulate fresh thinking and inform new strategies

Historical data to enable you to look at past market trends to inform your future plans and back testing needs

Platts™ Excel® Add-In or API feeds to enable you to act faster

Enterprise-wide access to our market data - Platts standardized benchmark data will drive consistency and reduce basis risk throughout your organization—from strategy, trading and planning, to treasury and asset optimization

A robust and transparent methodology that brings consistency to our price reporting specialists at every stage of the process

Platts Market Data Crude Oil Service gives you access to the breadth and depth of Crude market data, including Platts Dated Brent, Platts Dubai/Oman, Platts American Gulf-Coast Select price benchmarks, as well as Carbon Intensity calculations across upstream and midstream sectors.

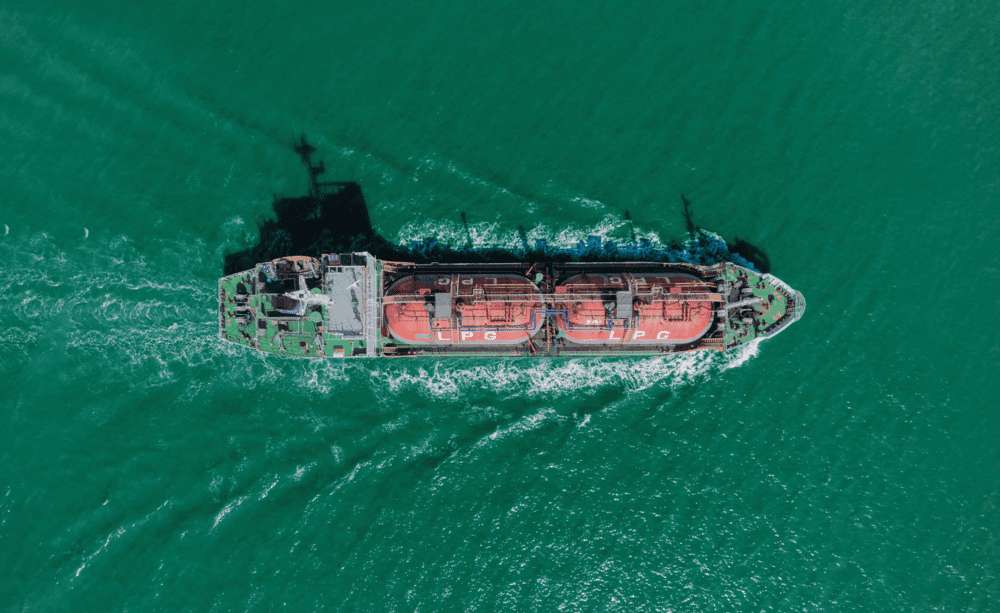

Platts Market Data Refined Service gives you access to over 95 refined products price benchmarks and 1000s more price assessments for a complete view of the global market, including gasoline, gasoil, natural gas liquids, LPG, SAF and many more.

Platts Market Data LNG Service gives you access to stay on top of LNG market globally, including JKM™ for the Japan-Korea region and West India Marker (WIM), North West European Marker (NWE) and the Gulf Coast Marker (GCM). Alongside LNG carrier data, you can see a complete picture.

Platts Market Data Natural Gas delivers the numbers you need to gauge your markets, your competition, and your future potential. Understand the fair and transactional value of natural gas and power markets, providing the transparency you need to spot opportunities and make decisions fast.

Managing Your Price Risks in Volatile Markets:

products volatility exposing National oil company to significant price risks.

Our daily lives are increasingly incorporating instant access to data, empowering us to make better decisions, quicker. The commodity markets are no different. Successful players are now making informed decisions by leveraging real-time data. Comprehensive coverage across prices, supply and demand flows and forward curves from S&P Commodity Insights can be accessed instantly via API, Streaming or FTP channels, helping you to develop an actionable understanding of what is truly driving price changes.

In today’s energy and commodity markets, it’s essential to have access to

data and

insights that help you confidently navigate business challenges and enable you to make

decisions with

conviction.

Complete the form, and a member of our sales team will contact you to discuss the challenges

you are

facing and how our product and service offerings can help you grow and succeed.

Markets Covered:

LNG

Market coverage:

Leading price benchmarks:

Managing Your Price Risks in Volatile Markets

Challenge: Volatility in oil markets meant a national oil company in Asia struggled to keep pace with prices and market developments when purchasing crude and refined oil products. Without access to timely information, they didn’t understand the underlying dynamics driving domestic and international markets and were consequently exposed to significant price risks.

Solution: We equipped them with crude and refined Market Data packages that include transactional pricing. Add vessel tracking from our Market Insight package, and it means they can now track margins and develop more robust forward plans.

Results: Armed with real-time pricing and analysis, they can confidently negotiate with foreign counterparties, mitigate pricing risk for cargoes being tendered, and optimize crude and refined product imports. The market data and insights we provide have also enabled them to understand and manage risks associated with refining margins, and they’re now better able to optimize these margins.